An Analysis of China’s Foreign Trade of Medical Devices in 2017

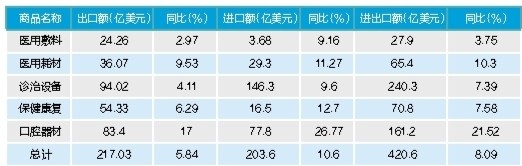

In 2017, China’s foreign trade in medical devices increased significantly compared with 2016, and imports and exports of all major categories of products increased. According to statistics from China Customs, China’s total import and export of medical devices in 2017 was US$42.06 billion, an increase of 8.09% year-on-year, exceeding the US$40 billion mark (see Table 1).

Table 1 China's Foreign Trade Structure of Medical Devices in 2017

Export reversed downward trend

According to statistics from China Customs, China’s medical equipment exports in 2016 fell 3.14% from the previous year. In 2017, equipment exports reversed the trend of the previous year's decline, showing a moderate upward trend - up 5.84% year-on-year, with total exports reaching 21.703 billion U.S. dollars, reached a new high record.

In the top 10 global markets for exports (see Table 2), except for the third largest Hong Kong, China, which fell 3.88%, the export volume of the other nine major markets showed varying degrees of growth. Among them, exports to the United States and Japan were 5.838 billion US dollars and 1.478 billion U.S. dollars, ranking first and second respectively. The growth rates of the two countries were 5.08% and 4.61% year-on-year, respectively; the largest increase was South Korea, with an increase of 19.04%. Exports amounted to US$658 million, ranking sixth.

Table 2 The top ten market statistics for medical device exports in 2017

In addition, China’s exports of medical devices to countries along the “One Belt and One Road” account for about 20% of total exports. Among them, exports to India, Russia, Malaysia, Vietnam and other countries have varying degrees of growth, respectively 7.51%, 5.05%, 1.52%, 3.86%.Russia used to be a fast-growing market for exports of medical devices in China. However, due to its economic slowdown in recent years, exports have suffered serious setbacks. In 2017, with the recovery of the Russian economy, China’s exports of its medical devices increased by 5.05% year-on-year and gradually fell out of the trough.

In 2017, exports of medical devices to other BRIC countries except India and Russia also showed a good situation. Among them, the increase in exports to Brazil was as high as 32.72% and the export value was 394 million U.S. dollars. It shows that the medical devices produced in China meet the market demand of the BRICS countries, have high cost-effectiveness and competitive advantages, and have potential for growth.

From the perspective of China's medical device export provinces (autonomous regions and municipalities), it is mainly concentrated in China's Pearl River Delta and Yangtze River Delta regions, and Guangdong, Jiangsu and Zhejiang provinces account for 60% of China’s total exports. In addition, in the top ten export provinces, except for Shanghai and Liaoning, the remaining provinces saw a significant increase in their export value, and Hubei, Shandong, and Anhui provinces had a 10% increase in export volume.

Middle and low end products still dominate

Although the export volume has increased, at present, China still mainly exports low-value consumables and medium and low end products in its export of medical device products. The industry relies heavily on low-cost elements such as raw materials and labor. The top ten export products, mainly massage and health care appliances and medical consumables, accounted for 44.5% of my total medical device exports. Among them, the export of massage equipment increased by 9.58% year-on-year, and the export value reached 2.292 billion USD (see Table 3).

Table 3 Statistics of the main products China’s export of medical equipment in 2017

In recent years, the high-end medical device industry in China has achieved rapid development with the support of the state and the efforts of enterprises, especially the imaging diagnostic equipment has gradually achieved import substitution. The influence of individual products, such as ultrasound and monitoring equipment, on the international market has also gradually emerged.However, in the field of large-scale equipment such as CT and NMR, due to the long-term global market monopoly by transnational companies, there is a large gap between the technical level and overall performance of high-end products in China compared to developed countries, and the clinical use time is short. The international market has a low degree of recognition. External exports are still at a disadvantage, and the internationalization road is a long way to go.

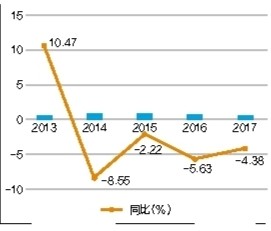

At the same time, the competition among medical device companies in China has become increasingly fierce. Especially in the export sector, the problem of low-price competition has become increasingly serious, and the trend of increasing export value by relying on price reductions has become evident. From 2013 to 2017, the average price of China's medical device exports dropped significantly (see Figure 1).

Figure 1 The average price of medical device export from 2013 to 2017

According to the data from the State Food and Drug Administration, the medical device market in China continued its high growth in recent years. Among them, imaging equipment, in vitro diagnostics and high-value consumables occupy the first three parts of the medical device market, accounting for 19%, 16% and 13% of the total market size, respectively.Policies, markets and new technologies continue to be the three major factors affecting the development of China's medical device industry. The full implementation of grading diagnosis and treatment will bring more opportunities for domestic medical equipment; the implementation of the "two-vote system" will further promote the transformation of mergers and acquisitions within the industry, the upgrading of industrial structure, and the development of medical device products in the direction of customization and high added value; The development of new technologies such as technology, artificial intelligence, 3D printing, and medical robots has brought about a disruptive revolution in the medical market.

According to the prediction of the China Chamber of Commerce for the Import and Export of Medicines and Health Products, the growth rate of China's foreign trade in medical devices will slow down in 2018, and medical devices will be the main force in the foreign trade of medical products in China. Challenges and opportunities will co-exist. While safeguarding the healthy development of foreign trade, Further deepening international cooperation will continue to be an overall trend.