KPMG: Prospects for the medical device industry in 2030

The days of “just relying on manufacturing equipment and then selling to medical service providers through distributors” no longer exist. Value is a new synonym for success, prevention is the best result of diagnosis and treatment, and intelligence is a new competitive advantage.This article examines how medical device companies succeeded in achieving a “three-pronged” strategy in 2030. Please read it.

The medical device industry in 2030 - as part of the solution

Reshape business and operating models

Medical device companies should carefully review existing organizations and reshape traditional businesses and operating models to suit future development through the way below:

– Integrate intelligence into product portfolios and services, positively influence the treatment process, and connect with clients, patients, and consumers.

– To provide services that go beyond equipment, beyond the intelligence of services - to truly move from cost to smart value.

– Investment-enabled technologies - Making the right choices to support multiple parallel business models based on clients, patients and consumers (potential patients) - and ultimately serving the organization's financial goals.

Re-locate

It is also important to consider preparing for the future from the perspective of “from outside to inside”. By 2030, the external environment will be full of variables, and medical device companies will need to reposition themselves in the new competitive landscape to deal with the following interference forces:

– New entrants, including competitors from unrelated industries

– New technologies because technological innovation will continue to be faster than clinical innovation

– New markets because developing countries continue to maintain high-speed growth

Refactoring the value chain

The value chain of traditional medical devices will evolve rapidly. By 2030, companies will play a very different role.After undergoing remodeling business and business models and repositioning, medical device companies need to rebuild their value chains and establish their position in the value chain.The "construction" of multiple value chains requires companies to make fundamental strategic decisions. It is now evident that manufacturers will continue to establish direct links with patients and consumers, or be integrated with healthcare services and even payment providers through vertical integration.The decision to rebuild the value chain is not intuitive, and it is likely to vary depending on the company's market segment (eg, equipment area, business unit, and geographic area).As other companies try to rebuild the value chain and achieve strategic goals, the value chain itself will evolve dynamically, making the situation more complex.However, the right choice will create great value for end users and help companies avoid the future of commercialization.

Beware of falling into a dilemma

Unbearable pressure to subvert the status quo

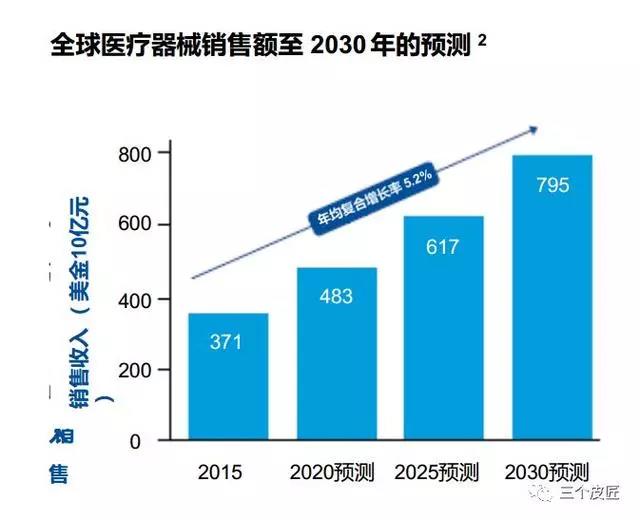

The medical device industry is expected to maintain steady growth. The global annual sales forecast is expected to grow at a rate of more than 5% per year, and sales will reach nearly $800 billion by 2030.These predictions reflect the growing popularity of modern lifestyle diseases, the growing demand for innovative new devices (such as wearables) and services (such as health data), and the economy of emerging markets (especially China and India). The enormous potential of development has been released.

Although the outlook is tempting, the priceless pressure of downward pressure still shrouds the industry like a haze. Governments around the world are trying to reduce the cost of healthcare - especially in the most expensive part of the healthcare system: hospitals.They want to spend less on medical devices and want to see greater value in achieving better treatment outcomes.

Evolutionary value chain

Competing in the future value chain of medical devices

Medical device companies have historically provided value primarily by manufacturing and selling products. However, as the pressure on the medical system increases and the medical service model has undergone fundamental changes, the industrial value chain will usher in major changes.

Under the new normal, companies need to get rid of the role of traditional manufacturers, integrate services and smart data with products, and provide overall solutions. This requires a "strength contest" in the value chain - while introducing the business-to-consumer (B2C) model, while consolidating existing business-to-business (B2B) models and creating new models. This strength contest may include a series of trading activities - mergers and acquisitions (mergers and acquisitions), strategic alliances and cooperation.

Reshape business and operating models

Far more than manufacturing equipment

The industry leaders in 2030 will be those medical device companies that establish relationships with clients, patients and consumers (end users) and actively provide value.Companies need to combine “intelligent” services and solutions that help reduce medical costs and improve outcomes, from treatment and cure to prevention. Technology will have a major impact and can help prevent it. If it is still needed, it can also provide efficient minimally invasive treatment options and reduce the time patients stay in the hospital.

Connect with clients, patients and consumers

To approach end users, manufacturers are now more likely to use data and add intelligence to their products than ever before—intelligence will soon become an important part of the new device's value proposition.Data and analysis tools enable companies to directly and continuously connect with users, place the importance of prevention on treatment and cure, and enable patients to better control their own treatment.In order to rapidly increase technical capabilities and effectively introduce smart services into their product portfolio, medical device companies may consider working with other companies.

Re-locate

New competition pattern

Due to new and non-traditional market entrants, disruptive technologies, and the rise of high-speed development markets with a focus on global players, the competitive landscape of the medical device industry in 2030 will be very different from that of today.

New entrants

The health care industry is being affected by disruptive forces, and this trend will continue into 2030. As the medical device industry needs to support higher-quality services at a lower cost, companies from various industries will continue to enter the medical device industry in the next decade. With the help of technology, these new competitors are likely to make today's value chain redundant - just like the changes made by other platform companies.

New technology

With exciting technological developments occurring at an unprecedented rate, technology may both promote and disrupt the medical device industry. The right choice is not intuitive. For continuous innovation, companies need to carefully evaluate and try.We believe that the following five technologies will help integrate intelligence into the product portfolio and will be used by winning companies in 2030, including wearable technology, smart device applications, Internet of Things, cloud data and analysis, and blockchain technology. We call them collectively "patient and consumer data sharing technologies."

Technology expands the role of medical device companies in the treatment process

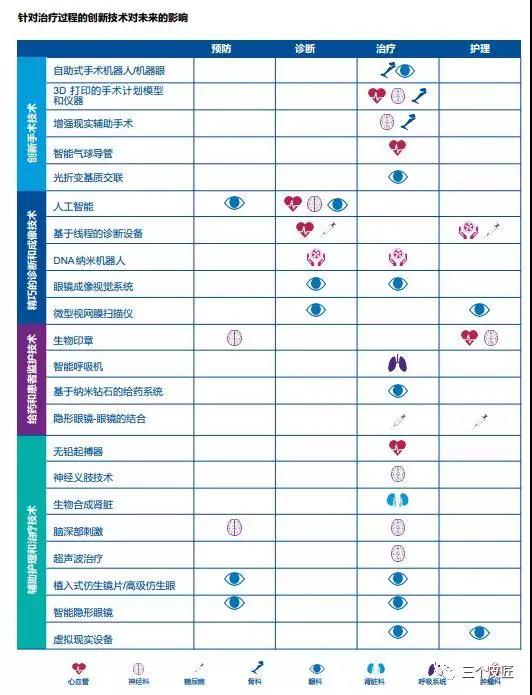

New technologies can not only create efficiency, save costs, and bring better results to medical service providers and patients; they also help medical device companies play a broader role in the treatment process by improving prevention, diagnosis, treatment and care.

New market

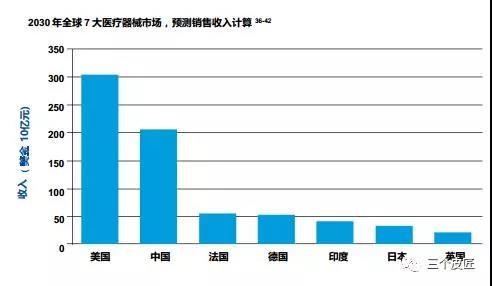

The United States will continue to dominate the medical device industry in 2030 and sales will exceed US$300 billion, but the top five markets will also include China (ranked second, accounting for more than 25% of global market share, and revenues exceeding US$200 billion 32). And India (ranked fifth, revenue will exceed 33 billion U.S. dollars).Driven by medical reforms, local government incentives, and the overall growth in medical demand, 3435, China and India have grown twice as fast as the overall market.These two countries are also rapidly developing into centers of innovation - India has been hailed as the global center of cheap engineering technology and has created many local (and low cost) devices with global market potential.

Refactoring the value chain

Take a seat in the future value chain

With the rapid development of the market, existing market participants need to consider how to position the medical device value chain in 2030 in order to avoid becoming a mere commodity supplier. Even the strongest and largest companies are vulnerable to new market entrants, global competition and technological advances.Medical device manufacturers must always focus on the value they bring to the future healthcare system. At the same time, they need to consider bold and necessary strength contests to rebuild the value chain.

Different segments of the company may require different value chain models, so careful evaluation of various options is needed to gain a full understanding. We believe that there will be several models until 2030, including:

1.Create a new B2C model

2.Strengthening and consolidating the B2B model

3.Bigger in the value chain

Keep Leading position in 2030

What can you do to start the journey towards 2030 and realize the strategy of “reshaping business and operating models – repositioning – restructuring the value chain”? In order to build a successful value chain model in the future, medical device companies should consider the following suggestions:

Determine value proposition

Wise investment

Collaborate and build ecosystems

Adopt a flexible, modular organizational structure

Don't let the past stand in the future