Blood glucose monitoring equipment market research analysis

The blood glucose monitoring market has huge space capacity. Continuing policies favor the import substitution of domestic equipment. At the same time, in the context of the new economy, a series of emerging service models have emerged in the traditional blood glucose monitoring industry.

1, huge market capacity, low domestic market penetration

According to the statistics of the China Diabetes Association, the number of diabetic patients in China has reached 114 million, the prevalence rate is about 9.7%, and the penetration rate of blood glucose monitoring systems is less than 10%, which is a big gap with developed countries.

Figure 1:lucometer penetration comparison

Sources: biological exploration, wealth securities

Relevant data show that the current global blood glucose monitoring system has a capacity of more than 20 billion U.S. dollars. In 2016, China's blood glucose testing market was about 6 billion yuan, and the penetration rate was only 20%, far below the average level.

2, the policy continues to be positive and promote the import substitution of domestic equipment

During the “12th Five-Year Plan” period, the Ministry of Science and Technology promulgated the “12th Five-Year Plan” for the medical device technology industry. In accordance with the planning requirements, it actively develops on-site rapid testing instruments in the diagnostic field ( POCT).

In 017, the General Office of the Ministry of Science and Technology released the "13th Five-Year Plan for Special Scientific Innovation in Medical Devices", clearly stating that during the "Thirteenth Five-Year Plan" period, it will vigorously develop intelligent on-site rapid detection systems, including the development of integrated dry chemistry analyzers and automation. Rapid Immune Detector, Pocket Sequencer, Portable Nucleic Acid Detector, Assay Reagents and Quality Control Products;Develop high-sensitivity on-site rapid detection technology and supporting reagents for non-invasive collection of samples. Develop research on non-invasive blood glucose monitors, wearable in-vitro detection technologies and equipment.

The policy continues to be positive, promotes the technical upgrading of domestic blood glucose monitoring products, enhances competitiveness, and changes the long-term import status of domestic high-end products.

3. Currently, the two major foreign brands Roche and Johnson & Johnson have dominated the market competition pattern. There are uncertainties in the future.

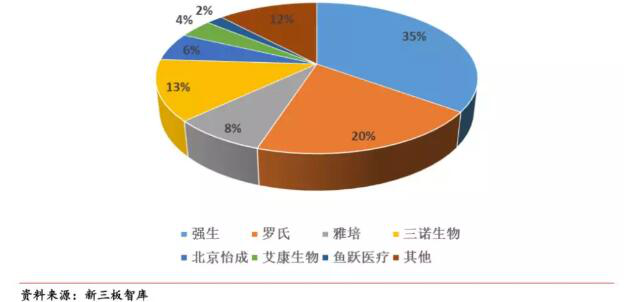

Judging from the current market competition pattern of blood glucose monitoring, foreign brands strongly dominate the market competition, with Roche and Johnson accounting for more than 50%.

Figure 1: Blood glucose monitoring market competition

Among them, 2017 Roche's financial report data shows that sales of diagnostic services increased by 5%. From the perspective of major sales regions, the Chinese market ranked first in major sales regions with a 21% share.

In addition, according to a Reuters survey, Johnson & Johnson Diabetes Care's revenue has been declining since 2012.In the first nine months of 2017, sales fell 7.7% year-on-year. At the same time, there have been reports that Johnson & Johnson had previously negotiated the sale of the Diabetes Business Unit with buyers from China, including Three Sino Biologicals.In 2018, Johnson & Johnson announced that it had received a quotation from the leading private investment company for the acquisition of Johnson & Johnson's LifeScan blood glucose meter business with a transaction volume of approximately US$2.1 billion.So whether the blood glucose meter business will be stripped from Johnson & Johnson and change the current competition pattern of blood glucose monitoring market in the future,we can wait and see.

4, The new economy fosters a new model of blood glucose monitoring

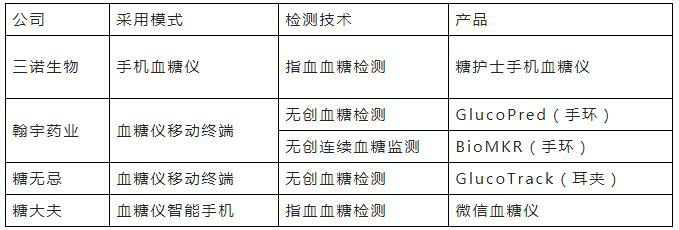

With the continuous application of the Internet, big data, and cloud computing technologies, traditional blood glucose monitoring equipment has emerged new product and service models to form new economic forms. The main products or services include non-invasive blood glucose meters, smart blood glucose monitors, cloud platform applications, etc.

Table 1 Some domestic smart blood glucose monitoring products

Source: Dongxing Securities Research Institute

In terms of smart cloud platforms, Johnson & Johnson Blood Glucose and Internet technology giant Huawei joined forces to build a "home blood glucose management cloud platform," so that more diabetics can easily and conveniently understand their own blood sugar conditions.In addition, Sinocare Inc. creates a new solution for blood glucose management in hospitals, the hospital's blood glucose management system. The system consists of a smart blood glucose meter and built-in APP, blood glucose management software, blood glucose database, interface software and bar code system.Nurses can use smart blood glucose meters to confirm patients, test blood glucose and upload data, and use blood glucose management software to manage patients, manage blood glucose meter controls, and print forms. At the same time, doctors can use a smart blood glucose meter to view blood glucose charts.

5,Overview of Domestic Leading Enterprises

Sinocare Inc.

Sinocare Inc. is a high-tech company dedicated to the development, production, and sales of biosensor technology for the rapid detection of chronic diseases.

As a national high-tech industrialization demonstration project for biomedical engineering, it has received support from the National Innovation Fund for several times and has taken the lead in adopting the ISO 13485 quality management system certification and the European Union CE certification.In January 2016, it took part in the acquisition of Trividia Health Inc. (formerly Niplo Diagnostics Co., Ltd.) in the United States, becoming the sixth largest blood glucose meter company in the world and entering the world's leading blood glucose meter camp.

Yuwell Medical

Headquartered in Shanghai, China, owns 7 R&D centers and 5 production bases in San Diego, Tuttlingen, Taipei, Beijing, Shanghai, Nanjing, Suzhou and Danyang.And it has set up a number of offices throughout the world, forming a complete network of research and development, production, marketing and service. In the context of the Internet,Yuwell is based on professional clinical medicine, providing patients with remote chronic disease management, remote medical diagnosis and other cloud medical services, and subverting traditional medical models.

ACON Bio

Founded in 1995, they successively passed the three major international certifications of the US FDA, European CE, and ISO13485 and were selected for the “Forbes China Potential 100 List” for three consecutive years.

Relying on the advantages in human resources between China and the United States, a complete industrial system for R&D, production and sales has been established in the field of bio-diagnosis.The product covers three major industries: in vitro diagnostic reagents, medical devices, and medical electronics.Successfully developed 100 A variety of rapid diagnostic products, including Ai Ke series of blood glucose meters, urine analyzers, dry biochemical analyzers, hemoglobin analyzers, blood lipid analyzers and other medical devices and corresponding detection reagents, PCR detection reagents, enzyme-linked immunoassay reagents, colloidal gold detection reagents, etc.It has obtained 80 China SFDA medical device certificates, 365 models of 80 products have obtained European CE certification, and the products are sold in more than 140 countries and regions in the world.